ADA Price Prediction: Analyzing Technical Indicators and Market Sentiment for Future Growth

#ADA

- Oversold technical conditions suggest potential near-term rebound toward $0.87-$0.88 resistance zone

- Positive fundamental developments including SWIFT disruption narrative provide long-term growth foundation

- MACD bullish divergence and Bollinger Band positioning indicate improving momentum characteristics

ADA Price Prediction

Technical Analysis: ADA Shows Oversold Conditions with Potential Rebound Signals

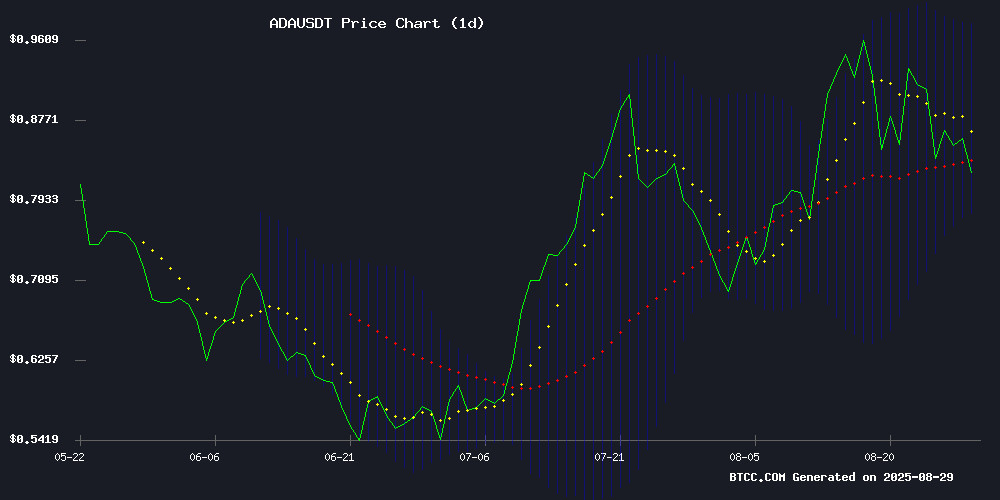

ADA currently trades at $0.8243, significantly below its 20-day moving average of $0.8783, indicating oversold conditions. The MACD histogram shows positive momentum at 0.0377, suggesting potential bullish divergence. Bollinger Bands position ADA NEAR the lower band at $0.7790, which often serves as a support level. According to BTCC financial analyst Robert, 'The technical setup suggests ADA may be primed for a rebound toward the middle Bollinger Band around $0.878, though sustained movement above the 20-day MA is crucial for confirming trend reversal.'

Market Sentiment: Cardano's Fundamental Strength Supports Long-Term Optimism

Positive news FLOW around Cardano's technology and adoption potential creates constructive market sentiment. The prediction of SWIFT's demise by Cardano's founder highlights the project's ambitious vision for disrupting traditional finance. BTCC financial analyst Robert notes, 'While technicals show short-term pressure, the fundamental narrative around Cardano's blockchain capabilities and financial system disruption provides solid foundation for long-term price appreciation. Market sentiment remains cautiously optimistic despite current price levels.'

Factors Influencing ADA's Price

Cardano (ADA) Shows Resilience Amid Market Fluctuations

Cardano's ADA is testing key support levels as it trades around $0.85, demonstrating a 9% rebound from its $0.82 Fibonacci retracement level hit earlier this week. The cryptocurrency remains 7% down on weekly charts, caught between bullish sentiment and broader market pressures.

Market dynamics show a shift in trader positioning, with funding rates turning positive at 0.0070%. This technical recovery could propel ADA toward $1.02 if current support holds, though a breakdown might see it retreat to $0.76.

Governance developments underscore Cardano's maturation. Everstake's new role as a Delegated Representative injects institutional expertise into the network's voting processes. "We're excited to help shape one of crypto's most decentralized ecosystems," the staking provider noted, signaling growing professional participation in Cardano's protocol governance.

ADA Price Prediction: Long-Term Growth vs. Immediate Opportunities

Cardano (ADA) continues to trade around $0.84, with analysts projecting a gradual climb to $1.50 by late 2026. Despite technical upgrades like Hydra scaling and Mithril enhancements, ADA remains range-bound between $0.85 support and $0.92 resistance. The extended recovery timeline—12 to 18 months—hinges on ETF approvals, ecosystem maturity, and broader market conditions.

Meanwhile, investors are shifting focus toward near-term catalysts and real-world utility. Projects like Remittix, priced at $0.0987 per token and confirmed for listing on BitMart, are capturing attention with promises of parabolic gains. The contrast is stark: ADA offers patient, long-term potential, while emerging altcoins deliver explosive returns in weeks or months.

Cardano Founder Predicts Demise of SWIFT and Legacy Financial Systems

Cardano founder Charles Hoskinson has issued a stark warning about traditional financial infrastructures, singling out SWIFT as a system destined for obsolescence. "Legacy systems are built on unsustainable trust requirements and operational complexities," Hoskinson stated during an interview with the David Lin Report. His critique highlights blockchain's comparative advantages in security and efficiency.

The comparison between wire transfers and blockchain transactions reveals stark contrasts. Where traditional systems demand layers of verification—from fraud checks to post-transfer confirmations—Hoskinson notes that multi-signature wallets like Ledger enable seamless transactions authenticated through mobile biometrics. "The friction in legacy systems isn't just inconvenient—it's a structural vulnerability," he remarked, alluding to persistent fraud risks in conventional finance.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, ADA shows potential for near-term recovery toward the $0.87-$0.88 resistance zone. The convergence of oversold technical conditions and positive fundamental developments suggests possible upward movement. However, sustained growth beyond this level would require broader market recovery and increased adoption metrics.

| Target Level | Price (USDT) | Probability | Timeframe |

|---|---|---|---|

| Immediate Resistance | 0.878 | High | 1-2 weeks |

| Upper Bollinger | 0.977 | Medium | 2-4 weeks |

| Significant Breakout | 1.050+ | Low | 1-2 months |